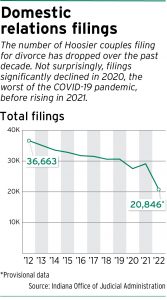

While the problem of what to do with the family car or truck is commonly asked when couples are divorcing, the choice turned much more fraught in 2021, when the international disruption brought on by the pandemic brought about used-automobile rates to soar to new-car degrees.

Kelly Lonnberg, member at Stoll Keenon Ogden’s Evansville office and chair of the firm’s family legislation follow, explained the increase in applied car or truck values as one particular of the “individual weirdnesses” that family lawyers have been encountering in these economically unsure situations.

Unemployment is very low and wages stay healthier, but fluctuating values spurred by crimps in the source chain as perfectly as stumbles in the inventory sector and housing industry are demanding relatives law practitioners to be resourceful when helping shoppers access a marital dissolution arrangement.

“It just would seem like the strain of obtaining divorced is higher in the previous three a long time than it was prior to that,” Lonnberg mentioned. “Nothing’s definitely calmed down. You would feel just after the COVID figures commence heading down that this would truly feel like a a lot less annoying occupation, and somehow it has not.”

The challenges loved ones regulation attorneys are dealing with have been induced by the 2022 economic upheaval.

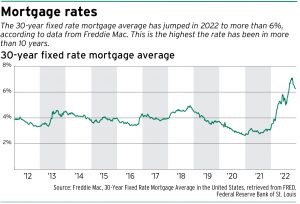

Inflation returned as the purchaser rate index for city people peaked at 9.1{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} in June 2022 right before falling to 7.1{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} in December, according to the U.S. Bureau of Labor Statistics. Curiosity charges continued to climb, with the Federal Reserve boosting the benchmark fee to a range of 4.25{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} to 4.5{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} at the conclude of 2022, the greatest level in 15 several years. Also, on Wall Road, the benchmark S&P 500 dropped more than 20{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} from the report high set in January 2022.

As a consequence, the values of properties and retirement accounts have been falling, creating a headache for household legislation lawyers trying to affix a really worth to what many couples contemplate their significant belongings. In addition, the mounting curiosity prices have set a strain on the offering or refinancing of marital properties.

Kathryn Burroughs, spouse at Cross Glazier Reed Burroughs in Carmel, said attorneys are having to get artistic to aid their clients navigate the uncertain terrain.

“No matter what, divorce is an financial hardship, even on rich couples. They’re getting rid of 50 {c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} their web marital estate,” Burroughs claimed. “But it impacts family members without implies significantly extra considerably. If you really don’t have savings and you really do not have quite a few property and all you have is credit score card personal debt, it is genuinely challenging to come across answers.”

Discovering options

With the source of new vehicles stalled, the selling price of used autos skyrocketed. As a result, Lonnberg had purchasers with 2- and 3-calendar year-outdated cars that were commanding prices greater than what they had compensated when the motor vehicle was new. Therefore, the issue grew to become no matter whether to use the “jacked up number” on the marital harmony sheet, because the price of the auto would most likely plummet the moment the supply chains had been performing.

Lonnberg mentioned the solution is dependent on what the wife or husband intends to do with the auto.

“If they are going to gain from the greater price then it’s possibly genuine range to include things like in the marital stability sheet,” she mentioned. “But if … they are likely to preserve driving it until the price of it does go back down, then possibly we use the amount from right before the supply chain kinked up.”

In Kokomo, loved ones law practitioner Sara Pitcher reported she has found spouses staying set when they are divorcing.

Earlier in 2022, houses were being promoting before they went on the current market or the working day the “for sale” indication was set in the front property. Now, nevertheless, moving out is more durable since of climbing curiosity premiums, Pitcher claimed.

Properties are lingering on the marketplace longer, generating product sales uncertain, while values are slipping so quickly that the rate quoted may possibly not be legitimate a few months later when the mediation begins.

If one wife or husband would like to stay in the house, the home finance loan will have to be refinanced to take out the ex-spouse’s title. But the better interest rates are growing payments, so the being partner could possibly not have the capability to deal with the new month-to-month amount of money.

Some couples concur to hold off refinancing for a calendar year in the hopes that the fees will drop, even though the leaving spouse will not be ready to buy an additional dwelling and might have issues leasing for the duration of that ready period of time. Other folks, as Pitcher observed, come to a decision not to depart at all.

Some couples concur to hold off refinancing for a calendar year in the hopes that the fees will drop, even though the leaving spouse will not be ready to buy an additional dwelling and might have issues leasing for the duration of that ready period of time. Other folks, as Pitcher observed, come to a decision not to depart at all.

“When things get restricted for men and women, it alterations the styles of settlements that are accessible to them,” she said. “So often that implies the only economic possibility for these functions is to go on to stay jointly whilst the divorce is pending when that would not have been their preference.”

For pensions and 401(k)s, provisions that account for gains and losses are supporting deal with declining values. Even so, Pitcher mentioned spouses who have noticed their retirement accounts shrink by $50,000 considering that the divorce petition was filed get skittish about dividing the money.

Lonnberg claimed a solution could be developed if a single spouse is younger or far more solvent and would not need to have to access retirement money as speedily as the other partner.

“If you have just one bash who just has much better monetary balance than the other, then probably they can get that account which is down appropriate now and hold all the gains when it recovers,” Lonnberg said. “And then the other bash gets the cash current market fund or the savings account or something that did not get strike by the shifts in the sector.”

Substantial cost of everything

Burroughs remembers practicing through the Terrific Recession, when the housing industry crash brought on banks to teeter, family members residences to drop into foreclosures and hundreds of thousands to get rid of their employment. While unemployment continues to be minimal and the median weekly earnings in the 3rd quarter of 2022 were 6.9{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} larger than a 12 months in the past, according to the BLS, Burroughs reported she views the current economic local climate as making far more hardship than 2008.

The cause is inflation. Homes are experience the sting of higher rates when they acquire groceries, fill up their cars and trucks or purchase just about any very good or provider.

“To me, this economic downturn would seem worse,” Burroughs explained, noting the Terrific Economic downturn brought a rapid decrease in the stock market, but inflation was not a element. “It appears like it is possessing a much more important effects on families who are likely by divorce.”

“To me, this economic downturn would seem worse,” Burroughs explained, noting the Terrific Economic downturn brought a rapid decrease in the stock market, but inflation was not a element. “It appears like it is possessing a much more important effects on families who are likely by divorce.”

Considering that 2009, Lonnberg stated she far more regularly suggests that customers seek assistance from monetary planners when producing decisions about issues like investments and marital true estate. She stresses they really should stay clear of the guidance of “your buddy up coming door” and locate “someone with some precise expertise in this space and decide which of these assets you’d like to test to get the most of.”

Economists are not anticipating an additional Wonderful Recession, but their predictions for 2023 hinge on interest charges. Gurus at the Indiana Enterprise Investigation Middle see the potential for serious careers losses in the state if the Fed carries on the monetary tightening, which could drop demand from customers for the strong goods designed in Hoosier factories.

To prepare, Burroughs is studying a lot more about the economic climate and creating wide ideas.

“I’m bracing for nearly anything,” she reported. “We have to. We have to keep artistic and be all set for regardless of what will come our way.”•

-The AP contributed to this report.