(Bloomberg) — Time is managing small for Vietnam to reduce a worsening house-sector credit score crunch from derailing one particular of the world’s speediest economic expansions.

Most Browse from Bloomberg

With about $4.6 billion of house developer notes tracked by Vietnam’s bond affiliation coming because of subsequent calendar year, the corporations will struggle to meet up with obligations with no federal government assist, in accordance to community authentic estate executives and analysts. Funding has all but dried up soon after an anti-graft marketing campaign spooked investors and authorities froze new bond issuance throughout the industry.

The looming maturity wall threats triggering a wave of defaults that could convert the property woes into a wider disaster for the banking sector and the financial system. Whilst the complete scale of Vietnam’s home credit card debt is little when compared to that of China, the field still makes up about 11{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} of financial action. Mounting worries of a China-type hit to growth are prompting phone calls for Vietnam’s govt to act before it is also late.

“The authentic estate sector is going through a major crisis,” mentioned Tran Xuan Ngoc, chief government at residence developer Nam Long Group. “We do not know when the crisis may well move as it depends on the government’s actions.”

At stake is an financial growth projected by the Worldwide Monetary Fund to hit 7{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} this yr thanks to strong gains in development and expert services. It also has implications for the nation’s banking industry, which has heavy ties to genuine estate. The two sectors comprise 50 {c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} of the stock benchmark’s weighting.

Signs of strain are already spreading. Fitch Rankings not too long ago approximated a 5{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} fall in house product sales up coming 12 months, which coupled with soaring prices will direct to a rise in leverage at residence corporations. A deficiency of dollars has compelled organizations to convert to shadow loans at very large interest prices and promote houses at savings as deep as 40{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8}. Nam Long’s Ngoc reported that it made use of to get about two months to provide 1,000 freshly-designed homes in Vietnam now it requires six to eight.

The industry’s problems are poised to worsen as bonds occur because of, with SSI Securities Corp. forecasting that upcoming year will be the largest for assets marketplace maturities at any time. There is not a whole lot of public info on maturities, with the the greater part of developers’ personal debt held in community forex. Most is held by community financial institutions and retail traders.

The residence disaster commenced before this calendar year soon after officials issued a crackdown on company bond issuances next allegations of illegal routines, placing off a series of actions to rectify the residence current market. That involved superior-amount arrests, a unexpected freeze of new issuances and an overhaul of the bond market.

Reforms Needed

Analysts are searching to an easing of the country’s bond principles as a probable force launch valve. A recent rule, acknowledged as Decree 65, pummeled assets stocks and chilled new bond issuance by raising the bar on disclosure needs as effectively as restricting the form of buyer to only institutional traders.

Any advancement in the nation’s assets industry will require major amendments to Decree 65, according to Maybank analyst Tyler Manh Dung Nguyen, who predicts the governing administration is possible to respond when it sees the subsequent spherical of developers’ corporate earnings up coming 12 months.

The authorities has now appeared to ease their stance, with the Thanh Nien newspaper reporting very last 7 days that Vietnam’s finance ministry is proposing a decree modification that would make it possible for businesses to prolong corporate bond maturities as considerably as two several years to ease a funding lack.

Vietnam’s leaders remain concentrated on the nation’s economic progress targets as it seeks to turn into a major production hub, acquiring by now attracted the likes of Apple Inc. suppliers and Samsung Electronics Co. That suggests Hanoi is ready to move promptly and proactively to deal with hazards. Finance Minister Ho Duc Phoc claimed previous month the authorities is having actions to relieve access to cash for developers specified the rout.

That may well not be ample, in accordance to Can Van Luc, chief economist at Lender for Expenditure and Growth of Vietnam. He reported that the govt will will need to do more to lure investors back again into the bond current market, these kinds of as shortening the software acceptance time for issuing company bonds to the general public from the latest degree of six months to a 12 months to a month or considerably less.

“The proposed actions have eradicated issues on the supply side, generating it simpler for issuers to breathe. However, a lot more desire-facet options are needed to maximize new hard cash circulation into the market place,” Luc explained.

Speeding up the method for developers to get authorized rights to establish land, lowering borrowing expenditures through amount cuts and making sure accurate bond sale disclosures will also help, in accordance to Tran Khanh Hien, head of analysis at VnDirect Securities Corp.

Strain Examination

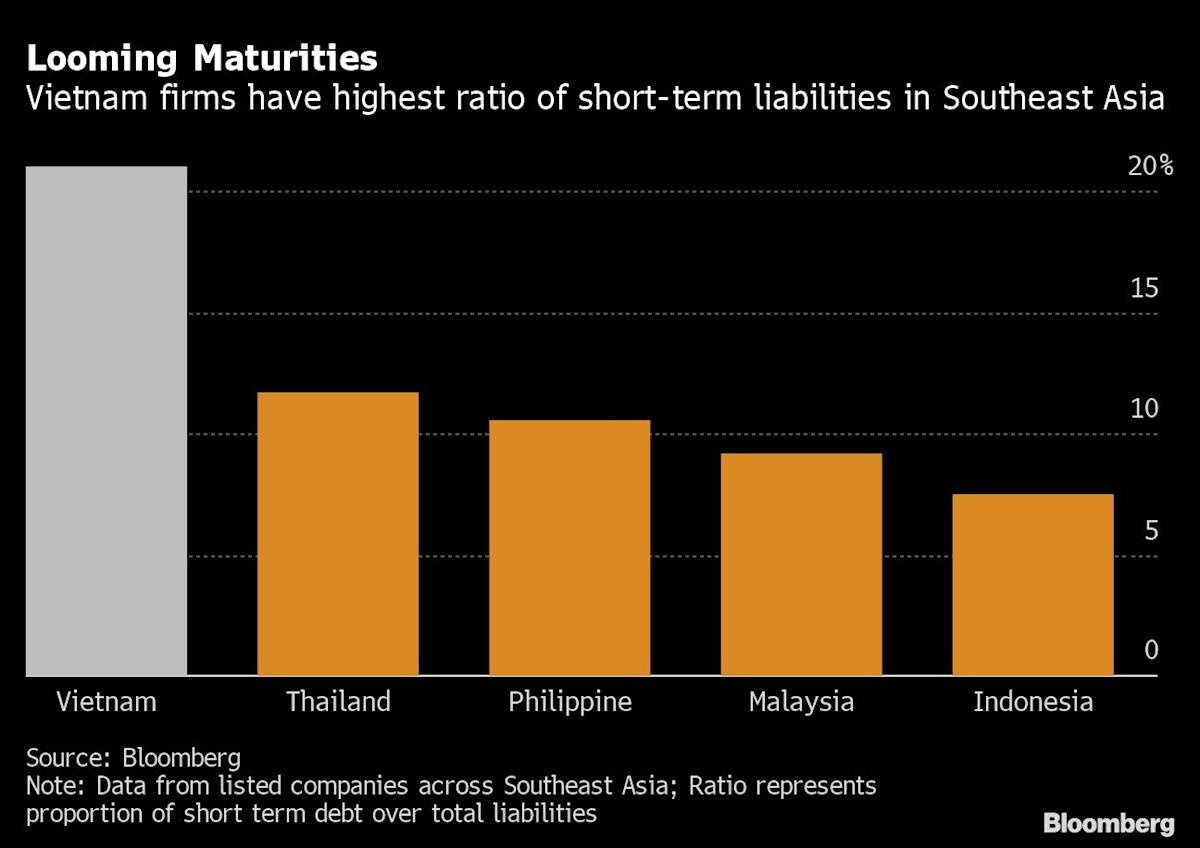

Cashflow is a major concern as refinancing dangers loom huge. The firms, which rely on short-phrase funding, are still digesting the new rules all over presenting and buying and selling company bonds just as they confront the $4.6 billion wall of debt owing up coming yr. The refinancing will turn out to be a “stress examination for developers’ reimbursement capacity,” Hien predicts.

Buyers in developer stocks have by now rushed for the exit, with shares of No Va Land Financial investment Team Corp., Hai Phat Financial investment JSC and Phat Dat Genuine Estate Progress Corp. sinking additional than 80{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} this yr. The previous is in the midst of restructuring its business enterprise. The serious estate association has mentioned the residence marketplace is at risk of a downturn that could be a drag on the overall economy, which is by now projected to drop from 7.4{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} this calendar year to 6.2{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} in 2023.

Creditors to the market may perhaps also undergo. Vietnam Technological and Industrial Joint-stock Bank, Tien Phong Business Joint Stock Financial institution and Armed service Business Joint Inventory Financial institution have home exposures that variety from 30{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} to 70{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} of their corporate bond portfolios, in accordance to an Oct. 18 evaluation by Viet Funds Securities JSC.

A broad selloff in shares is also hurting developers’ probabilities in boosting money in the stock market place. Vietnam’s fairness current market has tumbled 31{c024931d10daf6b71b41321fa9ba9cd89123fb34a4039ac9f079a256e3c1e6e8} so considerably this year, generating it the 2nd worst among the the international benchmarks tracked by Bloomberg.

“The assets market place will facial area headwinds in the short time period not just from policy moves, but also from the climbing fee atmosphere,” mentioned Nguyen Duc Hai, head of set money at Manulife Financial commitment Fund Management (Vietnam) Co.

–With help from Harry Suhartono, Mai Ngoc Chau, Nguyen Dieu Tu Uyen, Karthikeyan Sundaram and John Boudreau.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.