In past posts, I criticized equally the Biden administration’s authorized rationale for the president’s enormous scholar personal loan personal debt cancellation policy and a achievable substitute justification for it. But quite a few industry experts think these challenges will never ever get their day in court, due to the fact no a person will have standing to file a lawsuit hard debt cancellation. Most likely the administration sees this procedural problem as their ace in the hole: it does not make any difference if the lawful justification for your system is weak if no one particular can get into courtroom to obstacle it!

The dilemma of standing is a legitimate problem for opponents of the credit card debt cancellation coverage. But it need not be an insuperable a single. There are at minimum a few kinds of litigants who can plausibly get standing: 1 or equally homes of Congress, student mortgage servicers, and faculties that do not accept federally backed student financial loans, but contend with all those that do.

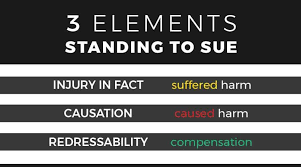

Less than recent Supreme Courtroom precedent, plaintiffs have to meet up with a few prerequisites to get standing to file a lawsuit in federal court: They ought to 1) have experienced an “damage in simple fact,” 2) the injuries in query have to be brought on by the allegedly illegal conduct they are complicated, and 3) a courtroom decision really should be capable to redress the injuries.

In my see, the whole doctrine of standing is not a authentic constitutional need, and the Supreme Court docket should abolish it. But that’s remarkably not likely to come about. So, for current applications, I will presume the validity of present precedent. Whether or not it can be proper or not, litigants will have to operate in just it.

The primary opportunity stumbling block in this circumstance is the requirement of “harm in truth.” It could be difficult to verify that scholar personal loan cancellation injures any one, in the feeling essential by Supreme Court docket precedent. Cancelling some of A’s scholar mortgage credit card debt will not automatically injure B and C. The some others may possibly imagine it is unfair they experienced to spend off all their loans themselves, when A won’t. But, with rare exceptions, recent precedent demands some type of tangible injuries. Unfairness, by by itself, is just not enough.

It may perhaps be that taxpayers endure a tangible personal injury, simply because bank loan forgiveness denies cash to the federal treasury, thus forcing them to bear extra of the stress of community expenditures. Any unlawful expenditure of community funds necessarily diverts taxpayer sources absent from duly authorized applications. But the Supreme Court docket has lengthy denied these kinds of taxpayer standing, in all but a several unconventional conditions, which are not relevant here.

I consider taxpayers should really have wide standing to challenge any unconstitutional expenditure of public money. But this is one more issue on which the Supreme Courtroom is unlikely to go my way, at any time soon.

But even though taxpayers normally do not have standing to challenge unlawful takes advantage of of general public money by the government, the Senate and the Property of Reps do! The US Court of Appeals for the DC Circuit so held in a 2020 case in which the Democratic-controlled Residence of Associates submitted a lawsuit demanding Donald Trump’s endeavor to divert armed forces funds to develop his border wall (a situation which has lots of parallels to the existing scenario). The choice was published by notable conservative Decide David Sentelle, who reasoned as follows:

[T]he Household is suing to cure an institutional damage to its have institutional electric power to avoid the expenditure of money not licensed. Taking the allegations of the grievance as correct and assuming at this phase that the Dwelling is accurate on the merits of its legal position, the Residence is independently and distinctly hurt mainly because the Government Branch has allegedly slice the House out of its constitutionally indispensable legislative function. Extra specifically, by paying out resources that the House refused to enable, the Executive Department has defied an convey constitutional prohibition that safeguards every congressional chamber’s unilateral authority to avoid expenditures….

To put it merely, the Appropriations Clause [of Article I of the Constitution] necessitates two keys to unlock the Treasury, and the Dwelling retains a person of those people keys. The Govt Branch has, in a word, snatched the House’s essential out of its palms. That is the harm about which the Household is suing…

To keep that the Residence is not hurt or that courts can’t recognize that injury would rewrite the Appropriations Clause. That Clause has prolonged been comprehended to test the energy of the Govt Department by allowing it to expend cash only as exclusively authorized…

Sentelle’s reasoning is persuasive, and pretty of course applies to Biden’s bank loan forgiveness plan, no considerably less than Trump’s border wall diversion. Below this approach, either the Household or the Senate would have standing to sue, even if the other house chose not to.

Of class neither dwelling is very likely to sue so very long as Democrats management both of them. But that could improve soon after the November election, when Republicans could probably retake one or equally of them (the Property considerably extra probable than the Senate). If so, they could depend on the border wall precedent to get the standing they want for a lawsuit.

However, the Property or Senate would possible have to file as an establishment in get to get standing. The Supreme Court docket has ruled that personal customers of Congress deficiency standing to sue the executive around fiscal challenges.

A next kind of entity that could get standing to sue is scholar bank loan servicers. These corporations accumulate pupil bank loan payments on behalf of the government, and the dimension of the costs they get relies upon in element on how much revenue is owed, whether the financial loan is delinquent, and how extensive the borrower will take to repay it. If mortgage forgiveness lessens delinquency rates, enables some debtors to repay more quickly, or in any other case affects the amount servicing companies get compensated, they fairly certainly undergo an damage in actuality, and would have standing to sue. Fordham legislation Prof. Jed Shugerman has achieved substantially the same conclusion.

It truly is attainable mortgage servicers will be scared to sue, mainly because they will not want to antagonize the federal Department of Schooling. A good partnership with the feds may be important to ensure their continued profitability. But if any are willing to sue, standing should not be considerably of a problem. And a single plaintiff is more than enough to get the issue to courtroom. Even if most bank loan servicers prefer to remain out of it, 1 may perhaps be willing to consider the threat. Alternatively, they could band with each other and sue jointly, therefore producing it more challenging for the Department of Education and learning to retaliate versus them (given that the Department may perhaps be reluctant to slice them all off).

A closing category of plaintiffs who could get standing is schools that refuse federal funding (which includes federal pupil financial loans), but compete with these who acknowledge it. These generally conservative-leaning institutions reject federal resources mainly because they do not want to be subject matter to the regulations that come with them. Illustrations contain Grove City College, and Hillsdale College or university. For evident factors, personal loan cancellation tends to make schools that settle for federal scholar financial loans extra competitive relative to all those that do not. The latter grow to be rather more cost-effective possibilities for learners.

Courts have lengthy acknowledged “competitor standing” to sue to obstacle guidelines that reinforce the competitive sector place of the plaintiff’s rivals. Possibly the competitive injuries below is little. Perhaps only a few college students are likely to forego attending Grove Metropolis School or Hillsdale as a result of Biden’s steps. But even a compact money reduction, such as nominal damages, is adequate to qualify as an “harm in actuality” less than standing doctrine.

These three options aren’t automatically exhaustive. They are just the types that most conveniently happen to me, and I confess I am far from being an expert on college student loans. There may be other forms of litigants who can also get standing to challenge Biden’s scholar credit card debt cancellation prepare. But these examples do counsel that standing have to have not be a display-stopper in this article. Much more probable than not, courts will ultimately have to rule on the legal deserves of the policy.